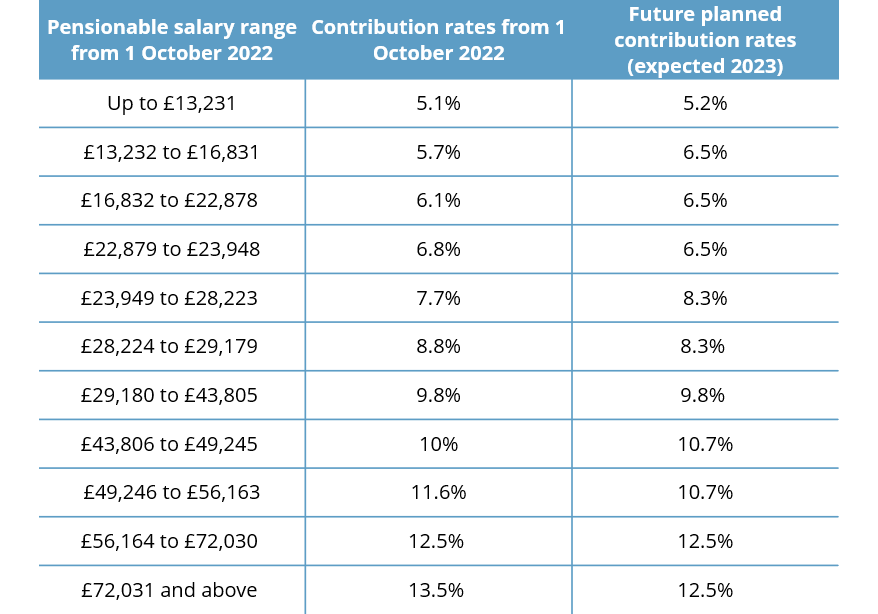

All members of the NHS pension scheme pay a percentage of their pensionable pay towards the scheme. From 1st October 2022, the amount you pay for your pension will change and further changes are planned in 2023. For many of you, this may result in a lower percentage paid in pension contributions.

The table below sets out the new rates:

These salary ranges are expected to change each year in line with any annual increase to Agenda for Change pay scales.

GP Practitioners

GP Partners already pay contributions based on total annual practitioner pay and submit pension forms each year. The new tiered rates will be taken into account via the form. Any GP who has a salaried post (practitioner or officer) should expect to see the new rates applied from October.

GPs performing other work such as locum sessions or GP Solo will need to review the rate applied to this income.

Part Time Workers

For part time workers, or for those of you who have more than one job, you may have previously paid contributions based on your whole-time equivalent pay. From October this has changed and you will pay based on how much you are paid rather than the pro-rata amount meaning you may pay a lower tiered rate.

Tax Planning

You may have previously planned to keep your pay under a certain threshold for tax planning reasons, to retain the ability to use certain childcare schemes or perhaps to keep your ‘threshold income’ under the limit where tapering applies when considering annual allowance pension tax. In these cases, you may need to review the plan as you may well pay a lower tiered rate from October thus increasing your taxable income.